How can organizations ensure a smooth and effective integration process that aligns with their strategic objectives and maximizes the value of their M&A activities?

The allure of mergers and acquisitions is irresistible – expansive new markets, game-changing synergies, and banners of transformation unfurled across executive suites. Yet, don’t be blinded by the glittering strategic logic behind most deals. The harsh reality is that 70% of M&As fail to deliver their desired potential, not because the strategy is flawed but because the integration lacks the necessary priority to be successful. Combining organizations demands navigating a complex minefield of disjointed processes, systems, and cultures. Despite optimistic projections, post-merger integrations rarely prove seamless. The celebratory deal announcement marks not the destination but the starting gun for exhaustive planning essential to capture touted value.

Successful integration requires business leaders to shed their strategic visionary hats and don the mantle of operational pragmatists. This means obsessing over the mechanics of value creation and proactively managing integration risks. This includes meticulously planning everything from IT and financial system integration to navigating cultural clashes between merged workforces. Dedicated Integration Management Offices (IMOs) are crucial, staffed with cross-functional teams equipped with M&A experience, functional domain knowledge, and robust project management tools. Early wins showcasing value creation and balancing harmonization with independent growth can alleviate employee concerns and demonstrate the concrete benefits of the merger. While each integration journey is unique, adopting an operationally focused, rigorously managed approach is essential for translating due diligence promise into tangible results.

The Overlooked Phase of M&A

The integration phase following a merger or acquisition is a significant determinant of the deal’s success. Historically, firms that manage this phase methodically are more likely to achieve, or even exceed, the expected benefits. However, many companies underestimate the effort and expertise required during this phase, leading to suboptimal outcomes.

Underestimating Integration Complexities

The Total Cost of Acquisition (TCoA) extends far beyond the transaction purchase price. It encompasses the resources and dedication needed to achieve the deal thesis – elements often overlooked in budgeting.

Furthermore, without a centralized approach, organizations face clarity and accountability issues, leading to costly delays, cultural misalignments, and strategic objectives not being met. Executives face the daunting task of ensuring a seamless and effective integration process that aligns with strategic goals and maximizes M&A value. The question is not only how to integrate but also how to do so in a way that sustains and enhances the deal’s intended benefits.

Launching the Integration Management Office (IMO)

The creation of an IMO addresses these challenges head-on. The IMO serves as the command center, coordinating the complex symphony of integration activities. This phase of the integration program is where dedicated teams, often bolstered by third-party experts, are established to drive initiatives from start to finish. The IMO ensures integration efforts are systematic and strategically aligned.

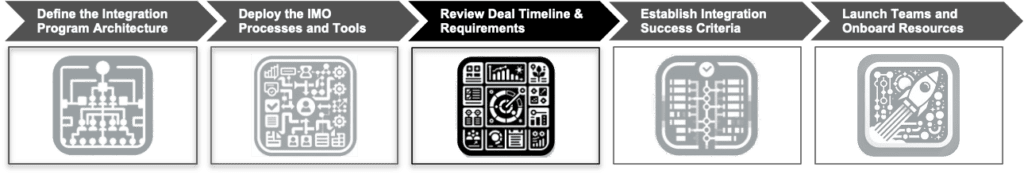

Define the Integration Program Architecture

The initiation of a successful integration begins with a well-defined program architecture. This framework serves as the blueprint for how both legacy organizations will function together. The Integration Management Office (IMO) plays a crucial role in this phase, meticulously defining and mapping organizational teams using a shared language and clear lines of accountability. Moreover, the IMO must strike a delicate balance between providing sufficient oversight to manage the integration and avoiding unnecessary bureaucracy that can stifle decision-making. A lean and agile governance structure ensures that the integration momentum is maintained without getting bogged down by red tape.

Accounting for organizational nuances and differing operating models is also essential. The IMO should recognize and plan for the integration of not only operational systems but also company cultures and employee expectations. The architecture should facilitate a merger that not only looks good on paper but also feels cohesive in practice. For example, consider the merger between Dell and EMC, two giants in the technology space with vastly different cultures and operational scales. The IMO’s first task was to create an integration architecture that preserved EMC’s innovative drive within Dell’s broader strategic framework. By establishing a unified terminology and creating clear lines of accountability, the IMO facilitated a merger that resulted in one of the largest technology conglomerates in the industry.

In conclusion, defining the integration program architecture is not a mere logistical step; it is the strategic underpinning that will dictate the effectiveness of the integration. A carefully crafted architecture, tailored to the unique aspects of the merging entities and their operational goals, sets the stage for the subsequent phases of integration, ensuring a process that is as smooth as it is strategic. The success story of Dell-EMC, among others, illustrates the pivotal role of a well-defined integration program architecture in realizing the full potential of an M&A deal.

Deploy the Integration Management Processes and Tools

The initiation of a successful integration begins with a well-defined program architecture. This framework serves as the blueprint for how both legacy organizations will function together. The Integration Management Office (IMO) plays a crucial role in this phase, meticulously defining and mapping organizational teams using a shared language and clear lines of accountability. Moreover, the IMO must strike a delicate balance between providing sufficient oversight to manage the integration and avoiding unnecessary bureaucracy that can stifle decision-making. A lean and agile governance structure ensures that the integration momentum is maintained without getting bogged down by red tape.

Accounting for organizational nuances and differing operating models is also essential. The IMO should recognize and plan for the integration of not only operational systems but also company cultures and employee expectations. The architecture should facilitate a merger that not only looks good on paper but also feels cohesive in practice. For example, consider the merger between Dell and EMC, two giants in the technology space with vastly different cultures and operational scales. The IMO’s first task was to create an integration architecture that preserved EMC’s innovative drive within Dell’s broader strategic framework. By establishing a unified terminology and creating clear lines of accountability, the IMO facilitated a merger that resulted in one of the largest technology conglomerates in the industry.

In conclusion, defining the integration program architecture is not a mere logistical step; it is the strategic underpinning that will dictate the effectiveness of the integration. A carefully crafted architecture, tailored to the unique aspects of the merging entities and their operational goals, sets the stage for the subsequent phases of integration, ensuring a process that is as smooth as it is strategic. The success story of Dell-EMC, among others, illustrates the pivotal role of a well-defined integration program architecture in realizing the full potential of an M&A deal.

Review Integration Timeline & Resource Requirements

A meticulously reviewed deal timeline and a comprehensive understanding of the integration resource requirements are crucial for synchronizing the strategic intentions with actual execution. The Integration Management Office (IMO) is responsible for leveraging the overarching integration strategy to inform all parties involved of the critical milestones and timelines that must be met for a successful Day One and beyond. Communication of key transaction milestones to integration teams is vital. This not only includes the target close date but also other critical milestones such as regulatory approvals, cultural alignment initiatives, and technology integrations. The IMO must distill these complex timelines into actionable items for the integration teams.

For instance, when tech giant Oracle acquired cloud-based software company NetSuite, the IMO played a critical role in reviewing and communicating the timeline. They ensured that all NetSuite’s cloud services would be smoothly integrated into Oracle’s suite without disrupting service for existing customers. By having a clear timeline that reflected both companies’ operational realities, the IMO enabled a seamless transition that met the requirements of both organizations and their customers. The example of Oracle-NetSuite demonstrates the critical nature of this step in ensuring a smooth transition that meets the strategic objectives of the M&A activity.

The rationale for a comprehensive review of the integration timeline and resource requirements lies in the necessity to maintain a strategic approach to integration, one that is informed by the deal’s objectives but also adaptable to the realities of execution. The IMO’s charter ensures that the integration does not get lost in a web of operational tasks, instead maintaining a clear focus on strategic objectives and value creation. In summary, this step is about setting the stage for the tactical aspects of the integration to unfold within a strategic framework.

Establish Integration Success Criteria

A successful integration is not just about merging two entities; it’s about creating a new, unified organization that operates effectively and meets its strategic objectives. To achieve this, the Integration Management Office (IMO) must establish clear, quantifiable success criteria. These criteria are based on key operating metrics that reflect the strategic goals of the merger or acquisition. This step involves not only setting these metrics but also mobilizing the integration strategy to support their achievement.

The rationale behind establishing clear integration success criteria is rooted in the need for a measurable, objective way to gauge the effectiveness of the integration efforts. It ensures that the integration is not just a series of tasks being completed but a strategic endeavor that is driving the newly formed organization toward its defined goals. Moreover, these criteria serve as a guiding light for the integration teams, aligning their efforts with the broader strategic objectives of the acquisition. They provide a way to celebrate milestones, learn from challenges, and continually refine the integration approach. In essence, the success criteria turn the vision of the merger into tangible, measurable outcomes, ensuring that the integration efforts translate into real value for the organization.

In the landmark acquisition of LinkedIn by Microsoft, the establishment of integration success criteria was pivotal in steering the merger towards success. Microsoft’s Integration Management Office (IMO) meticulously developed key performance indicators (KPIs), focusing on user growth, platform integration, and revenue synergy to ensure that the strategic goals of the acquisition were met. Business and leadership scorecards were employed to monitor these KPIs, providing a structured framework to measure the progress of the integration across various dimensions. Standardized templates facilitated consistent tracking of integration metrics, ensuring transparency and enabling data-driven decision-making. This strategic approach to establishing and managing integration success criteria allowed Microsoft and LinkedIn to effectively align their operations and cultures, culminating in a merger that redefined professional networking and enterprise productivity solutions.

Launch Integration Teams and Onboard Resources

The launch of teams and the onboarding of resources mark a critical transition from planning to action in the post-merger integration process. It is at this juncture that the Integration Management Office (IMO) must ensure the strategic objectives encapsulated in the integration scorecards are effectively communicated and ingrained in the operational ethos of the integration teams. This phase is about more than just combining workforces; it’s about instilling a shared vision, aligning expectations, and fostering a culture that supports the goals of the newly formed entity. Formal kick-off meetings and comprehensive onboarding sessions are instrumental in achieving this, serving as platforms to clarify objectives, roles, and responsibilities, and to galvanize the integration teams around the common purpose of the merger.

The ultimate aim of launching teams and onboarding resources is to transition from strategic planning to strategic execution. The integration teams, once fully onboarded and aligned with the integration’s goals and metrics, become the driving force behind the realization of the merger’s potential. Their coordinated efforts, guided by the clear roles and responsibilities established during onboarding, ensure that the integration progresses as a cohesive, strategic endeavor. This phase solidifies the foundation laid by the IMO, transitioning the merger from a vision and a set of plans on paper to a living, evolving entity poised to achieve the strategic objectives set forth at the outset of the integration.

In the merger between Google and Android, this strategic approach to team launching and resource onboarding was pivotal. It allowed for the harmonious integration of Android’s innovative mobile technology with Google’s extensive ecosystem, nurturing a culture of innovation while driving forward Google’s vision of a connected and technologically advanced future.

In Conclusion

In the complex landscape of M&A, the journey from deal closure to fully realized integration is fraught with challenges, yet it offers a fertile ground for strategic growth and innovation. The Integration Management Office (IMO) stands at the forefront of this transformative process, steering the integration through meticulous planning, structured execution, and a deep understanding of the nuanced interplay between corporate cultures, systems, and goals. Through the systematic approach outlined in this article, business leaders are equipped to navigate the intricate maze of post-merger integration, ensuring that the strategic vision that prompted the deal is translated into operational success and tangible value. The journey, exemplified by successful integrations like Google and Android, underscores the importance of a proactive, disciplined, and culturally sensitive approach to integration—an approach where the IMO is not just a facilitator but the architect of a new, unified future. In essence, mastering post-merger integration through the imperative of the IMO is not just about combining entities; it’s about forging a new path of growth, innovation, and enduring success in the ever-evolving business landscape.