How can organizations effectively navigate the operating complexities of post-merger integration during the interim and future state operation models?

In the fast-paced world of mergers and acquisitions (M&A), the integration of companies is a critical determinant of success. This process goes beyond the mere combination of assets and extends into the unification of cultures, operational processes, and systems. The successful execution of such integrations is fundamental to unlocking the value promised by the merger, ensuring that the combined entity not only survives but thrives in its new form. However, navigating the complexities of this integration presents a formidable challenge, one that demands a meticulous and strategic approach to blend the diverse elements of each organization into a cohesive whole.

Despite thorough due diligence and integration planning, many organizations encounter significant challenges during the preparation for Day One, the first day after the deal closes, and the post-merger integration phases. These challenges often stem from inadequate preparation in designing a future state that addresses the complexities of combined operations. Without a clear blueprint for integration, companies risk operational disruptions, cultural misalignments, and failure to achieve the merger’s full potential.

Bridging the Gap Between Today and Tomorrow

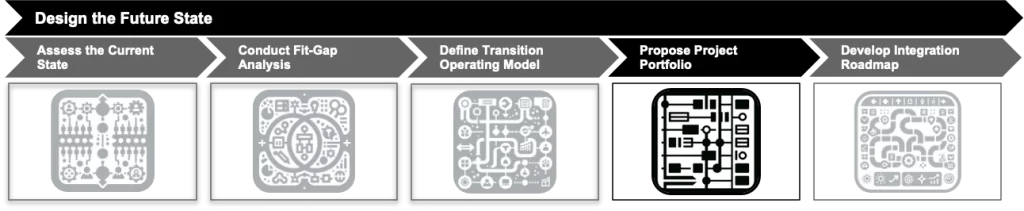

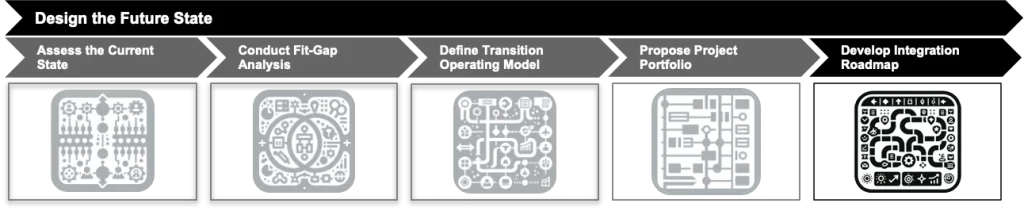

At the heart of post-merger integration is the Design the Future State phase, a strategic approach that ensures the operational and cultural amalgamation of merging entities. This phase is underpinned by several key steps: conducting a Current State Assessment, performing a Capabilities Fit-Gap Analysis, defining the Transition Operating Model (TOM), proposing a project portfolio, and developing an Integration Roadmap. Each of these steps is designed to bridge the gap between current operations and the envisioned future state, ensuring a strategic, targeted, and aligned integration process.

Decoding the ‘As-Is’ State in M&A Integration

The current state assessment is a critical first step, requiring a multi-faceted approach to develop a nuanced understanding of both organizations. Key activities include process mapping to document operational flows, evaluating key performance indicators to compare metrics, analyzing organizational structures and reporting lines, and conducting qualitative assessments of cultural dynamics through interviews, focus groups, and surveys. The goal is to leave no stone unturned in understanding the ‘as-is’ state, uncovering inefficiencies, dependencies, and potential integration challenges.

A meticulous current state analysis provides the essential foundation for effective post-merger integration. By highlighting processes at risk for disruption, incompatible systems, and potential culture clashes, preemptive mitigation plans can be put in place preventing larger problems down the road. Often, deep analysis also reveals unexpected synergies and strengths hidden within the organizations. This informs decisions around optimizing processes, technology consolidation, and cultural integration. A key consideration is whether internal capabilities are sufficient for an unbiased analysis, or if outside expertise should be engaged for a more objective perspective. Thorough understanding of the current state is integral for smooth integration and capturing the full benefits of the merger.

Charting Strengths and Synergies

The Capabilities Fit-Gap Analysis is a critical component in the post-merger integration process, serving as a strategic tool to transform the assessment of current state strengths and weaknesses into actionable insights. This analysis is foundational in identifying the strategic alignment of capabilities with the merger’s objectives, whether for expansion, new product development, or realizing cost-cutting synergies. By undertaking a comprehensive cataloging of capabilities, including customer relationships, brand power, go-to-market strategies, product functionality, and back-office infrastructure, organizations can create a detailed inventory that spans the breadth and depth of both entities. This detailed view supports the strategic focus on aligning capabilities with merger goals and uncovers the ‘best of both worlds’ by comparing processes, systems, and assets to identify efficiencies and strengths in execution or technological advantages.

The systematic identification of discrepancies and overlaps through the Fit-Gap Analysis lays the groundwork for informed and strategic integration planning. Highlighting areas of potential disruption, incompatible systems, and cultural clashes enables organizations to devise preemptive mitigation strategies, effectively avoiding major integration pitfalls. This analysis not only identifies areas ripe for immediate value creation but also prioritizes integration projects, ensuring that resources and change management efforts are focused where they can yield the most significant impact. Early identification of misaligned capabilities allows for proactive management of potential friction points, such as differing technology standards or sales approaches, minimizing disruptions and smoothing the path for a more efficient integration process. This strategic approach is instrumental in realizing the full potential of the merger, facilitating a seamless transition, and enabling the newly formed entity to capitalize on identified synergies and hidden strengths.

Bridging Uncertainty with the Power of Transition Operating Model (TOM) Design

The concept of the Transition Operating Model (TOM) emerges as a linchpin for bridging the initial gap between deal closure and the ultimate goal of full integration. The design of an effective TOM is a delicate balancing act that necessitates a cohesive focus on both immediate operational needs and the strategic roadmap toward enduring integration. Central to this concept is the establishment of clear governance structures and decision-making processes, which are essential for steering the merged entity through its interim state with minimal friction. This phase also demands a rigorous analysis of workflows and dependencies, ensuring that critical processes are harmonized early on to facilitate seamless hand-offs and maintain business continuity. Moreover, the role of strategic communication cannot be overstated, as it underpins the entire integration effort by keeping stakeholders informed, engaged, and aligned with the evolving organizational narrative.

The strategic significance of the TOM extends beyond mere operational continuity; it is a foundational element in the broader context of change management and risk mitigation within the merger process. By preemptively addressing potential areas of disruption and establishing a clear framework for decision-making and escalation, the TOM safeguards the organization’s value proposition during a period of inherent vulnerability. It not only preserves critical customer relationships and employee morale but also provides a clear direction during the transitional phase, thereby empowering employees to contribute effectively amidst the restructuring. Additionally, by setting the stage for the subsequent phases of integration, the TOM facilitates a smoother transition to the future state, reducing the need for retroactive adjustments and accelerating the realization of synergies. This dual focus on immediate functionality and strategic foresight underscores the TOM’s role as a vital instrument for navigating the complexities of merger integration, ultimately enabling the combined entity to capture the full spectrum of envisaged benefits.

Translating Insights Into Impactful Initiatives

The crucial phase of translating strategic merger goals into well-defined integration projects operationalizes the insights gained from the fit-gap analysis. This transition involves a synergy-focused framework that prioritizes projects addressing gaps and areas for optimizing combined capabilities, directly fueling the strategic ambitions outlined in the M&A rationale, such as achieving cost savings, accelerating innovation, or entering new markets. Key to this phase is project definition and scoping, where each proposed project is clearly outlined with scope, timeline, success metrics, and resource requirements. This ensures strong accountability by specifying project team leads and defining interdependencies across integration streams. Furthermore, data-driven prioritization assesses project impact through metrics like projected cost savings, timeline to synergy realization, and risk level, driving data-backed decisions that shape the subsequent roadmap construction.

A well-structured project portfolio emerges as both a tactical and strategic lever for realizing merger goals, translating to crucial benefits in the integration process. It provides a basis for measurable progress through clearly defined projects that establish tangible milestones and metrics for tracking. This enables leadership to monitor whether initial hypotheses regarding synergies are materializing, allowing for necessary adjustments in resource allocation. Specific project assignments enhance cross-functional ownership and accountability, streamlining the execution process and preventing delays often associated with “big bang” merger implementations. Additionally, a thoughtfully curated portfolio enables precise risk assessment for each project, whether operational, financial, or related to human capital, facilitating more controlled management within a project framework. This phase prompts a key consideration: balancing the granularity in project breakdown to drive effective planning and execution without succumbing to “analysis paralysis,” ensuring initiatives remain on track with sufficient specificity.

Balancing Oversight With Agile Execution

The integration roadmap is pivotal in turning the strategic visions and goals from the project portfolio phase into a structured, phased, executable plan for the newly merged entity. This phase is instrumental in establishing meaningful milestones that are directly aligned with the project goals and the overarching rationale of the merger, such as achieving revenue targets through cross-selling, realizing cost savings from supply chain harmonization, or the successful market launch of products derived from combined R&D efforts. It involves meticulous mapping of project interdependencies to identify the optimal timing for execution, thereby prioritizing foundational components and analyzing resource constraints to maximize efficiency in parallel workstreams, all while maintaining a realistic perspective on organizational capacity. The establishment of dedicated oversight mechanisms, notably the integration management office (IMO), equipped with cross-functional project management teams, ensures the seamless achievement of these milestones. The IMO acts as both the communication hub and the driving force behind the successful realization of project goals, facilitating a coordinated effort across the entire integration landscape.The dynamic nature of the integration roadmap positions it as a critical tool for alignment and agility within the merger process, balancing the pursuit of long-term goals with the flexibility to adapt to changes. Clear milestones and the strategic sequencing of projects underpin the shared direction, ensuring that all teams are unified in their focus and efforts towards achieving common integration objectives. Utilizing visual tools such as timelines and Gantt charts, the roadmap enhances comprehension of the planned progression, thereby fostering a cohesive understanding of the integration journey among stakeholders. Additionally, the roadmap’s comprehensive structure brings potential bottlenecks and friction points into early visibility, allowing for proactive mitigation strategies or contingency planning to address conflicts, such as technology incompatibilities. As a living document, the roadmap facilitates adaptive strategy, enabling the organization to navigate the complexities of integration with the agility to make necessary course corrections. The guiding question for leadership in this phase revolves around the balance between sufficient oversight and the need for agility, questioning whether a decentralized approach might dilute focus and execution or if a strong, top-down control is essential for keeping the myriad projects on track without veering into micromanagement.

Applying the Framework for Post-Merger Success

In the acquisition of MuleSoft by Salesforce for $6.5 billion in 2018, the integration strategy exemplified the comprehensive application of the “Design the Future State” framework, showcasing how rigorous planning and structured implementation can bridge organizational cultures and product portfolios to unlock synergistic value. Salesforce embarked on an extensive current state analysis, crucial for understanding the integration risks, cataloging core capabilities, and defining transitional decision structures. This meticulous approach allowed Salesforce to identify areas of synergy between its CRM, marketing automation capabilities, and MuleSoft’s API and data integration technologies, setting a clear direction for the unified vision of creating a seamless customer 360 platform.

The development of a targeted integration project portfolio and the establishment of clear accountability mechanisms facilitated the effective capture of specific synergies, such as the integration of Salesforce’s Einstein AI with MuleSoft’s Composer to enhance workflow automation and data insights for clients. Governed by strict timelines, the integration process culminated in the successful launch of Einstein Automate, illustrating the significant revenue increase attributed to the synergies realized from the MuleSoft acquisition. Salesforce’s structured approach, from conducting an in-depth current state analysis to defining a detailed integration roadmap, served as a blueprint for navigating the complex process of merging disparate technologies and cultures, thereby achieving strategic objectives and driving growth in the highly competitive technology industry.

Embracing a Structured Approach

In navigating the complexities of mergers and acquisitions, mastering post-merger integration stands as a hallmark of strategic success. The journey from conceptualizing to actualizing a unified entity requires more than just blending assets; it involves a deeply strategic process of integrating cultures, systems, and operational frameworks. This synthesis is not just about survival but about leveraging combined strengths to thrive and outperform in an increasingly competitive landscape. The blueprint for integration, articulated through phases such as assessing the current state, analyzing capabilities fit-gap, and designing a transition operating model, forms the scaffolding upon which sustainable growth is built. These steps, meticulously planned and executed, ensure that the integration process is not only strategic and targeted but also aligned with the overarching goals of the merger.

The culmination of this process, transitioning from insightful planning to impactful execution, sets the stage for the newly merged entity to actualize the envisioned synergies and strategic advantages. By investing in this structured framework, organizations can address the intricacies of integration, from operational disruptions to cultural alignments, companies can mitigate risks and seize opportunities for innovation and expansion. The strategic foresight embedded in the development of an integration roadmap underscores the importance of adaptability and alignment, ensuring that the combined entity is well-positioned to navigate the uncertainties of post-merger integration. This journey, marked by the harmonization of diverse organizational elements and the strategic alignment of business objectives, exemplifies the essence of mastering post-merger integration: blueprinting the future state for strategic success.